The Hidden Cost of DIY Bookkeeping: Why Small Business Owners Are Losing More Than Just Time

Reading Time: 8 minutes

Published by Wake Triangle Bookkeeping Solutions

When Sarah opened her boutique marketing agency three years ago, she was confident she could handle everything herself. After all, how hard could bookkeeping be? She'd taken a business course in college, knew her way around Excel, and was naturally organized. Fast forward to last April, and Sarah found herself in tears at 2 AM, frantically trying to reconcile nine months of transactions before her CPA's tax deadline.

Sarah's story isn't unique. In fact, it's the story we hear almost every week here at Wake Triangle Bookkeeping Solutions.

The Real Numbers Behind DIY Bookkeeping

Let's talk about what DIY bookkeeping actually costs small business owners in the Raleigh-Durham area. And I'm not just talking about money - though we'll get to that.

The Time Trap

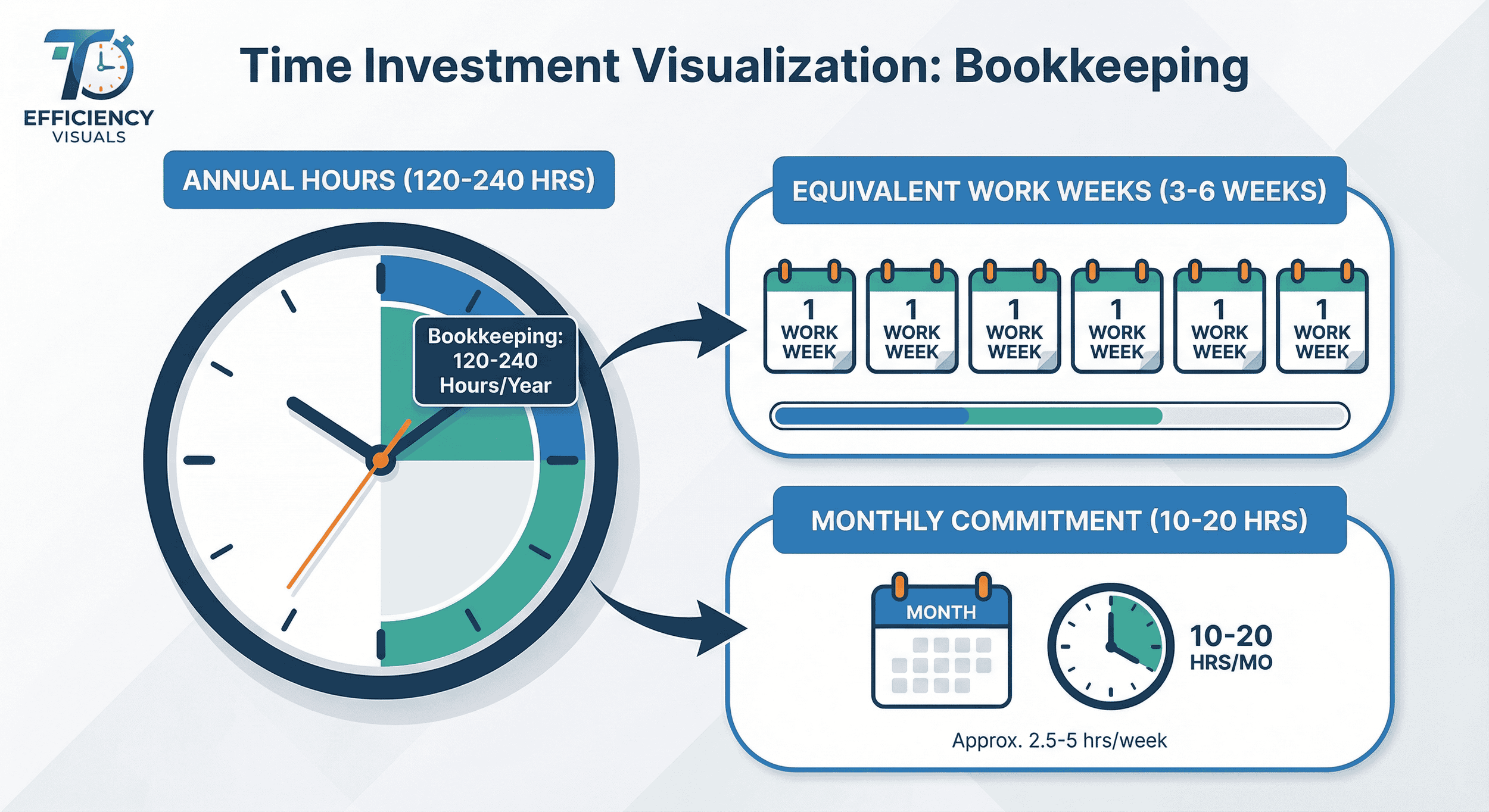

According to recent small business surveys, business owners spend an average of 120-240 hours per year on bookkeeping tasks. That's 3-6 full work weeks dedicated to categorizing transactions, reconciling accounts, and generating reports instead of serving clients, developing products, or growing your business.

Think about what you could do with an extra 200 hours:

Sign 10-15 new clients

Launch that new service you've been planning

Attend industry conferences and networking events

Spend more time with your family

Actually take a vacation without your laptop

But time is just the beginning of what DIY bookkeeping really costs.

The Seven Hidden Costs Nobody Talks About

1. Missed Tax Deductions (The $3,000-$8,000 Mistake)

When you're rushing through your bookkeeping or doing it sporadically, you miss deductions. That home office percentage? Miscalculated. Vehicle mileage? Underreported. Professional development expenses? Forgotten in a drawer somewhere.

We've seen businesses leave thousands on the table simply because transactions weren't properly categorized or documented. One of our real estate investor clients was missing nearly $7,200 in legitimate deductions annually before we cleaned up their books.

2. Late Payment Penalties and Interest

When your books are disorganized, you lose track of payment deadlines - both money owed to you and money you owe to others. This creates a cascade of problems:

Sales tax penalties: Late sales tax filings in North Carolina can cost 5% per month up to 25% of the tax due, plus interest

Vendor late fees: Typically $25-$50 per occurrence, adding up quickly

Cash flow disruption: When you don't know who owes you money, you can't follow up on overdue invoices

One e-commerce client came to us after receiving a $2,400 penalty for missed sales tax filings across multiple quarters. The irony? They actually had the money - they just didn't have the systems to track and pay on time.

3. Poor Business Decisions Based on Incomplete Data

Here's where DIY bookkeeping gets really expensive. When your financial data is outdated, incomplete, or inaccurate, every business decision you make is essentially a guess.

Should you hire that new employee? Can you afford to lease a bigger space? Is that marketing campaign actually profitable? Without accurate, timely financial reports, you're flying blind.

We had a professional services client who thought they were profitable because money was coming in. When we organized their books, we discovered they were actually losing $1,200 per month due to untracked expenses and underpriced services. Within three months of having accurate reports, they restructured their pricing and improved profitability by over $18,000 annually.

4. The Opportunity Cost of Your Expertise

Let's do some math. If you're a business owner billing $100-$200 per hour for your professional services, but spending 10 hours per month on bookkeeping (valued at $35-$50/hour if outsourced), you're losing the opportunity to earn $650-$1,500 per month in revenue.

Over a year, that's $7,800-$18,000 in lost revenue opportunity - all because you're doing work that isn't in your zone of genius.

5. Stress and Mental Health Impact

This one's harder to quantify, but it's perhaps the most insidious cost of all. The constant worry about whether your books are accurate, the Sunday night dread about catching up on bookkeeping, the anxiety before tax season—these take a real toll.

Multiple clients have told us that the relief of knowing their books are accurate and current has improved their sleep, reduced their anxiety, and made them more present with their families.

6. Audit Risk and IRS Complications

Disorganized books significantly increase your audit risk. When the IRS does come knocking, incomplete or inaccurate records can turn a routine audit into a nightmare, potentially resulting in:

Additional taxes owed

Penalties and interest

Costly professional representation fees

Weeks of stress and disruption

Clean, professional bookkeeping is your first line of defense in an audit situation.

7. Difficulty Securing Financing or Selling Your Business

When you need a business loan or line of credit, lenders require clean financial statements. If you're considering selling your business someday, buyers will conduct extensive due diligence. Messy books can:

Delay or prevent loan approval

Reduce your business valuation

Scare away potential buyers

Cost you months in deal negotiations